Auto Shop Equipment Financing Options Explained

Estimated 0 min read

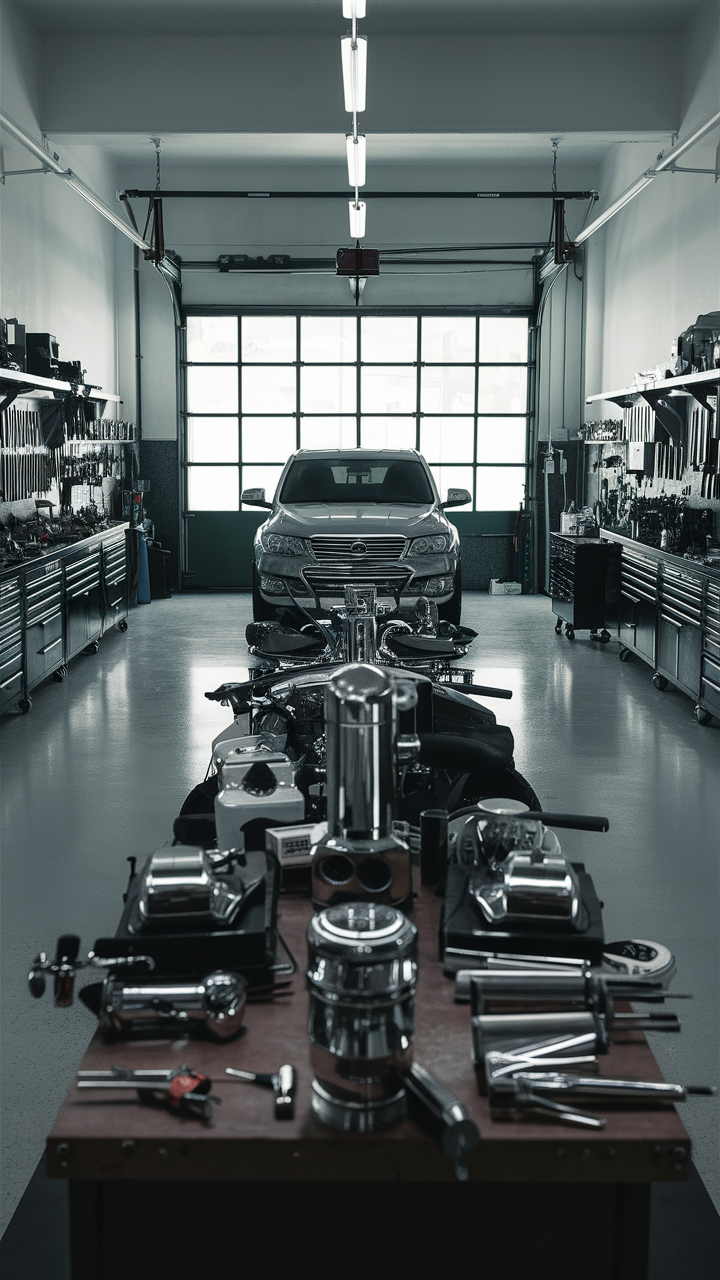

Auto shop equipment financing is a strategic approach for automotive businesses to obtain crucial tools and machinery without a large upfront payment. This method allows businesses to buy necessary equipment and pay for it over time, keeping their cash flow intact. The market offers various Automotive Garage Financing Solutions, catering to the unique needs of auto shops.

Equipment acquisition loans for auto businesses are a key borrowing option for workshops. These loans help shop owners buy advanced technology and essential tools for smooth operations. For example, Trust Capital Finance provides 100% financing for auto repair equipment, with loans up to $250,000 through a simple one-page application. Loans for up to $5,000,000 require detailed financial information.

To qualify for these financing options, applicants must meet specific financial standards. Start-up auto repair shops need a minimum credit score of 600, while established businesses require a score of 650 or higher. Loan terms vary, offering flexibility with payments over 12 to 72 months. Additionally, 100% prefunding is available, with no down payment needed for eligible borrowers, making these solutions accessible.

Automotive businesses can also benefit from aggressive trade-in, upgrade, and refinancing programs. Trust Capital Finance's FlexLease option allows customers to upgrade to newer technology during the contract term. This ensures businesses can stay competitive with the latest tools and equipment. Up to 120% of the total cost may be financed, and soft costs like installation and delivery are often covered.

Eligibility for equipment financing extends to both new and used equipment purchases, and such costs are tax deductible. There are numerous borrowing options for auto workshops, covering everything from automotive lift equipment to diagnostic test software. These comprehensive financing solutions support auto shop owners in maintaining and expanding their operations efficiently.

Types of Auto Shop Equipment Eligible for Financing

Auto repair shops heavily depend on specialized equipment for efficient operations. Financing options allow business owners to invest in crucial tools without a large upfront payment. Essential items like four-post lifts and alignment racks are eligible for financing. These tools are vital for accurate repairs and ensuring vehicle safety.

Moreover, tools such as tire changers and digital wheel balancers are covered by many Vehicle Repair Tools Financing Plans. These tools are essential for maintaining a comprehensive service range in an auto shop. Diagnostic tools, crucial for identifying engine and other vehicle issues, can also be financed.

Specialized equipment like pipe benders, oil filter crushers, A/C recovery machines, and brake lathes are also part of Auto Shop Gear Funding Programs. Financiers recognize the importance of these tools, often including them in their plans. This makes it easier for auto repair shops to get the equipment they need.

First Capital Business Finance, among others, offers extensive Auto Mechanic Equipment Financing options for both new and established businesses. These programs allow auto shop owners to finance a wide range of equipment. This ensures their operations remain competitive and efficient.

Traditional Business Loans for Auto Repair Shop

Traditional business loans from banks and credit unions are a key option for securing Auto Shop Equipment Loans. These loans require a detailed business plan, financial statements, and proof of repayment capabilities.

For owners looking into Commercial Auto Repair Financing, the main challenge lies in meeting traditional lenders' strict criteria. A stellar business credit score is essential, and lenders often demand at least three years of financial history. This can be a hurdle for startups needing Equipment Loans for Garages.

oan terms vary widely. Auto repair shop loans can last from 3 to 10 years, with rates starting at 9%. Payments are usually monthly, but short-term loans can have repayment periods of 3 to 18 months.

However, traditional bank loans for auto repair shops can take up to 60 days to process. This makes them unsuitable for urgent funding needs. Auto repair shop owners might look into alternative financing options for quicker access to funds and more flexible requirements.

In conclusion, traditional business loans can offer significant funding for auto shop equipment. Yet, the strict eligibility criteria and collateral needs underscore the importance of well-prepared applications. Owners may also consider alternative lending sources for quicker and more flexible financial solutions.

Click Here for Financing Options For Car Lifts & Equipment

Small Business Administration (SBA) Loans

The Small Business Administration (SBA) offers crucial financial support to small businesses, including auto repair shops. Through its government-backed loan programs, SBA Auto Shop Loans provide benefits like lower down payments and extended repayment terms. The SBA 7(a) Loan Program for Auto Businesses is the most prominent option available.

The SBA provides loans from $500 to $5.5 million, tailored to various business needs. For instance, loans of $50,000 or less help businesses and certain non-profit childcare centers. The SBA 7(a) Loan Program offers long-term financing for small enterprises, being the primary method for partnering with lenders to increase small business access to capital.

Government-Backed Garage Financing under SBA loans supports diverse needs such as purchasing furniture, real estate, machinery, and equipment, or even for construction and remodeling projects. This flexibility and potential practical benefits enable auto repair shop owners to invest in long-term projects without immediate financial strain.

SBA-guaranteed loans typically have competitive rates and fees, similar to non-guaranteed loans. They also offer support, including counseling and educational resources for business owners. These features can greatly aid the growth and sustainability of auto businesses, especially in a dynamic industry that has seen a 2.5% growth rate over the past five years and is projected to continue growing.

Finally, auto repair shop owners should select an SBA lender based on their experience, loan programs, and track record in assisting with SBA financing. Government-Backed Garage Financing through SBA programs provides a reliable path for auto businesses to thrive and expand, ensuring financial stability and growth.

Financing Options for Auto Shop Equipment

Auto repair shop owners have various financing options for upgrading or acquiring new equipment. Equipment Acquisition Loans for Auto Businesses are a favored choice, offering loans up to $5 million per piece. These loans start with interest rates of 3.5% and have terms from 1 to 6 years. The interest rates can fluctuate, with traditional commercial banks offering the lowest rates. Online lenders and marketplaces are gaining traction, providing quick funding with less stringent credit checks.

These loans help spread the cost of expensive equipment over time, enhancing cash flow for other needs. Auto Repair Shop Loan Options typically require collateral, like the equipment being financed, and may ask for a driver's license, vendor invoice, and financial statements. The minimum requirements include a credit score of 600, at least one year in business, and annual revenue of at least $250,000.

Equipment leasing is another financing alternative, allowing businesses to use tools and machines for a set period with monthly payments. This is ideal for equipment that quickly becomes outdated. Leasing helps avoid large upfront costs and allows for upgrading to newer equipment as needed. Businesses must weigh their priorities between building equity through ownership versus leasing's flexibility.

Choosing the right financing or leasing option can greatly impact an auto repair shop's operational efficiency and growth. Whether opting for Equipment Acquisition Loans for Auto Businesses or Auto Repair Shop Loan Options, it's crucial to evaluate the terms, interest rates, and repayment plans carefully.

Click Here for Financing Options For Car Lifts & Equipment

Benefits of Equipment Financing for Auto Shops

In the competitive world of auto repair shops, managing capital effectively is crucial. One major benefit of auto shop financing is the ability to upgrade or replace essential equipment without draining working capital. This financing allows shops to keep liquidity while gaining access to the latest tools and machinery.

Furthermore, the financial benefits of equipment loans for auto shops are substantial. Many financing options come with tax benefits, as lease payments can be deducted as business expenses. This can result in significant savings over time. Additionally, the equipment acts as collateral, reducing the need for additional assets to secure the loan.

Flexible repayment terms are another key advantage. Financing programs are available for both new startups and established businesses, offering terms up to 60 months. This flexibility ensures auto repair shops can manage their payments according to their financial situation.

Financing solutions streamline auto repair shop capital management. Whether a business needs alignment equipment, automotive body saws, diagnostic equipment, or painting booths, financing makes these costly investments more feasible. Through partnerships with over 25 different lenders, businesses can secure fast approvals, often within 48 business hours, ensuring they don’t experience prolonged downtimes.

In summary, adopting equipment financing offers clear advantages. From immediate access to necessary equipment to preserving working capital and optimizing tax deductions, auto repair shops can greatly benefit. This strategic financial approach ensures that auto shops can continue to deliver top-tier services without financial strain.

Equipment Leasing: An Alternative to Loans

Equipment leasing for auto mechanics brings numerous benefits over traditional loans, particularly in terms of lower upfront costs. It allows businesses to sidestep the hefty down payments loans typically demand, thus conserving cash for other essential operational expenses.

Leasing agreements frequently include maintenance packages, which aid in managing operational costs. This feature distinguishes leasing from loans, as it encompasses repair and update costs. It ensures that auto repair shops can effectively manage unexpected expenses.

When evaluating leasing versus loan options, it's crucial to recognize that leasing often eliminates the need for an initial down payment. This can significantly reduce an auto shop's upfront costs by thousands of dollars. Furthermore, leasing agreements typically offer flexible terms, enabling businesses to upgrade to newer equipment or return it at lease expiration.

Leasing also shields auto mechanics from the impact of equipment depreciation. As technology evolves, the value of machinery can plummet swiftly. Leasing mitigates this risk by allowing shops to utilize the latest technology without shouldering the full burden of depreciation.

In conclusion, equipment leasing emerges as a strategic financial tool for auto shops. It provides access to vital tools and machinery while offering financial flexibility and operational efficiency. In the lease vs. loan debate, leasing emerges as a practical choice for contemporary auto mechanic requirements.

Factors to Consider When Choosing Financing Options

When selecting right financing options for auto shops, evaluating several key factors is crucial. Interest rates, repayment terms, and fees are essential components of this equipment financing evaluation. These elements significantly impact the overall cost and feasibility of the financing option.

An auto shop's credit score and financial history are pivotal in auto shop loan decision making. They determine the financing options available and the terms and interest rates lenders offer. Understanding the potential resale value of the equipment also aids in making a well-informed decision.

Assessing the flexibility of the financing option is critical. The chosen financing should match the shop's long-term goals and operational needs. This flexibility might include favorable repayment schedules or loan restructuring possibilities.

Financial viability is another key aspect. Shop owners must show their financial stability through market research and a solid business plan. This makes them more attractive to lenders, increasing the chances of securing funding.

Finally, the guidance of experienced business professionals can improve decision-making. Their expertise in navigating financing complexities can lead to better outcomes for auto repair shops. These factors ensure auto shop owners make informed financing decisions, supporting their growth and sustainability in a competitive market.

How to Apply for Auto Shop Equipment Financing

Applying for auto shop equipment financing requires several key steps. First, identify lenders that cater to your needs. Specialized lenders like TAB Bank and Triton Capital offer solutions tailored for auto repair shops. When applying, ensure you have all financial documents ready, including business licenses, registration, and financial statements.

Next, prepare a detailed business plan to present to lenders. A strong business plan, along with a solid financial history, boosts your chances of approval. Lenders often prefer businesses with at least one year of operation and $250,000 in annual revenue. A minimum credit score of 600 is typically required. You can finance various equipment, from hydraulic lifts to oil pumping systems, with loans ranging from $10,000 to over $5 million.

After submitting your application, lenders will review your credit thoroughly. Online lenders are often more flexible than traditional banks, offering quick funding within 3-10 business days. Some, like Funding Circle, can approve loans for businesses as young as six months, with a minimum annual revenue of $50,000. If all criteria are met, the approval process can be as swift as 24 hours, ensuring your shop can quickly acquire the necessary equipment.

Mechanic Superstore Has Financing Options Available

We currently offer a few options for Car Lift Financing here at Mechanicsuperstore. Visit our financing page to learn more about our available options and to fill out an application if you need financing options to add new equipment to your garage.